Podcast: Floorplan, Carvana Subprime ABS

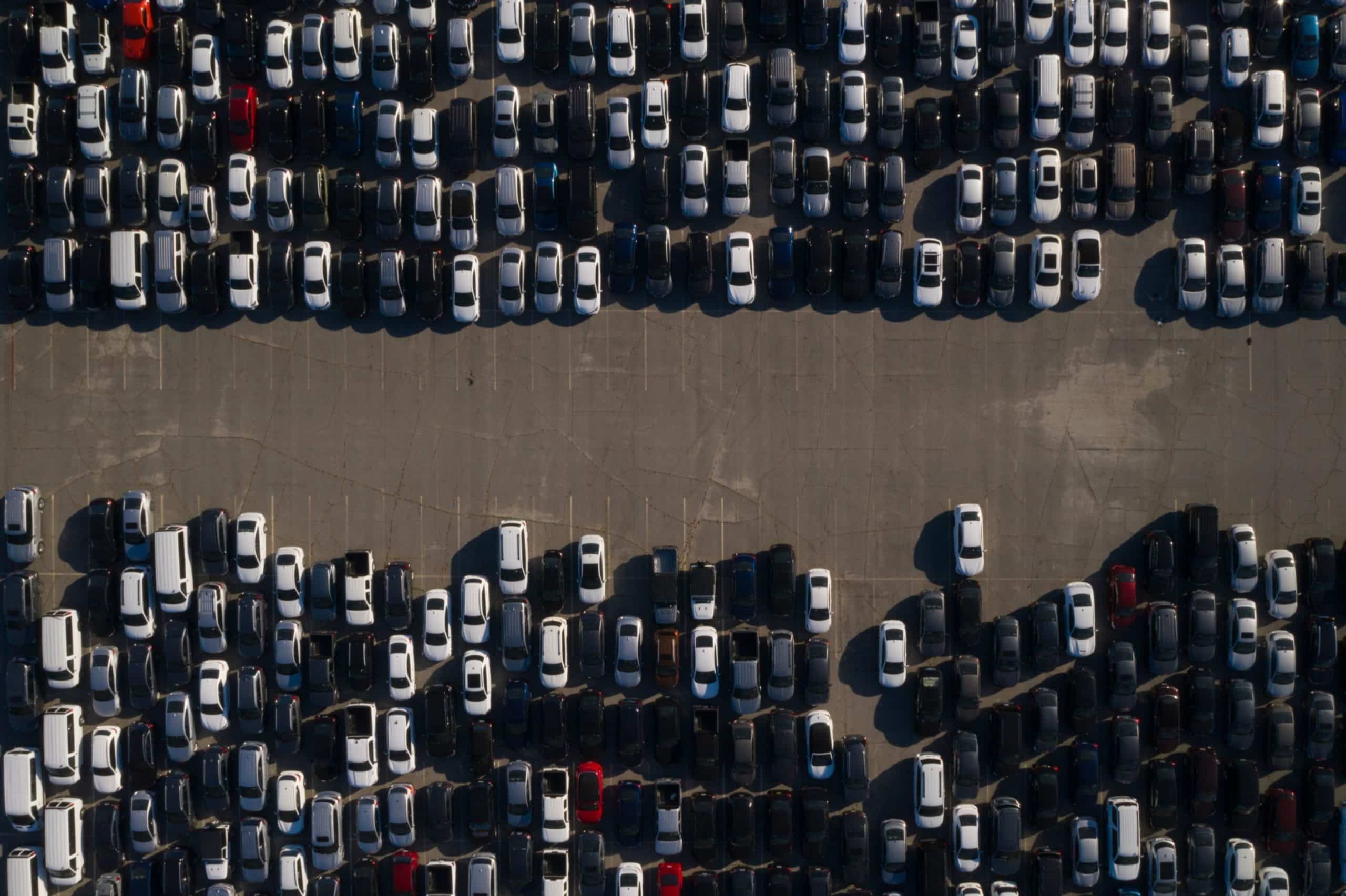

The floorplan financing landscape is changing as inventory improves and dealerships consolidate in the face of elevated interest rates and pent-up demand.

Some floorplan lenders are capitalizing on lender pullback in the space, with independents First Business Bank and NextGear Capital filling the void from banks that pulled back floorplan financing, while Chase Auto and Huntington grew their portfolios due to dealer consolidation and GM Financial increased its reach across GM dealers.

Meanwhile, Carvana is tapping back into the auto asset-backed securities market with its third subprime auto ABS transaction this year.

In this episode of the “Weekly Wrap,” Editor Joey Pizzolato, Deputy Editor Amanda Harris, Senior Associate Editor Riley Wolfbauer and Associate Editor Johnnie Martinez discuss the top stories for the week ended Sept. 8, and what to expect in the week ahead.

Subscribe to “The Roadmap Podcast” on iTunes or Spotify, or download the episode.

Auto Finance Summit, the premier industry event for auto lending and leasing, returns Oct. 29-31 at the Bellagio Las Vegas and features fireside chats with Vroom and Ford Credit. To learn more about the 2023 event and register, visit here.

Transcript:

Editor’s note: This transcript has been generated by software and is being presented as is. Some transcription errors may remain.

Joey Pizzolato 0:09

Hello everyone and welcome to the roadmap from auto finance news since 1996, the nation’s leading newsletter on automotive lending and leasing. It’s Monday, September 11. And I’m Joey Pizzolato, joined by Amanda Harris Riley Wolfbauer and Johnny Martinez. This is our weekly wrap on what happened in auto finance for the week ending September 8 2023. In automotive news, auto sales slowed in August but remain healthy marking a potential tailwind for the automotive industry as OEMs work to rebuild supply. The seasonally adjusted annualized rate clocked in at 15 Point 2 million units working increased from 13 point 2 million units in August 2020 to 2022, but it declined from 15 point 7 million units in July. According to data from the Federal Reserve Bank of St. Louis. This slowdown could allow OEMs to rebuild inventories and get more affordable models on to dealership lots. But a looming United Auto Workers strike, however, could slow production. Wholesale use vehicle prices rose sequentially for the first time since mall March excuse me, halting the slide in value since their increase through the first three months of the year. The Manheim use vehicle value index came in at 212.2 in August inching up 0.2% month over month on a cease seasonally adjusted basis, but declining 7.7% year over year. US vehicle retail sales, meanwhile, are initially estimated to be up 5% sequentially and 0.8% year over year in August, as the average retail listing price for a used unit took down 0.4%. According to V auto data. Using values may have increased this month due to dealers bolstering inventory in the face of a potential UAW strike, which would bring further inventory challenges to an other otherwise recovering supply environment. Hopefully, it’s only a used car dealer majority owned by Severus Capital Management filed for bankruptcy and Senate plans down to wind down its business because of unprecedented changes to the automotive retail landscape. Florida based company and its affiliates filed for Chapter 11 Bankruptcy on Thursday, listing assets and liabilities between 100,000,500 million. Hopefully it’s only follows us auto sales and America’s car market, both of which shuttered operations earlier this year. In auto finance, what’s like financial is working with the guy and technologies to offer AI based underwriting looks like we’ll also leverage a guy his relationship with asset managers to secure additional funding for loan production. Automation, finance, formerly CMG financial ceased accepting applications from some independent dealerships as the financier prioritizes US auto nation USA locations AutoNation finance sent notifications to affected independent dealers August 31, detailing a shift in focus to auto nation’s franchise stores and US Car Auto nation USA stores. Captive stopped accepting applications from the dealerships on September 1, but will honor already issued approvals prior to their expiration dates. According to the notification, Nirvana came to market with its third subprime ABS deal of the year. Amanda has the details.

Amanda Harris 3:33

Yes, so Carvana, you know, is pretty much had a cadence of about one prime and one non prime issuance per quarter. So it seems to be that they’re sticking with that. So this is their third Subprime Auto ABS deal of the year. And what kind of stood out to me in this one is it did show a higher share of non prime loans, that they’re originating than some of their past past years, and compared to some prior deals. And that’s just, you know, a function of you know, they’re doing a little bit better, they have some some, you know, pretty good standing in the market now. And obviously, they’re feeling pretty good about those nonprime borrowers. They are still, you know, focus, I think, on the the higher tier that but we are starting to see them shift toward, you know, lower quality credit originations after really pulling back on that lower credit tier and focusing on higher quality originations during the past couple of years. So it was just interesting, that kind of shows what they kind of feel about the market and where they stand right now following their, you know, debt restructure that they did and some of the other things are doing to kind of shore up their liquidity and operations. So we should start seeing, you know, some of those kind of metrics show up in their next couple of deals. The thought is they’ll continue issuing in the capital markets, they’ll probably continue that cadence, another prime another learned subprime deal for the rest of the year. And then we’ll you know, kind of look into those and see how they compare but pretty pretty aligned with their previous nonprime deals. Nothing really stood out as anything super different. Aren’t interns are pretty similar, you know, cost funds pretty similar. So they’re really different there. But definitely they’re keeping to their cadence and just shows ABS market is pretty strong overall, Carvana was one of many issuers that came to market in the last couple of weeks and months, just as the market is doing pretty well. So we’ve been kind of seeing that big uptick happening, as well as their earnings kind of doing a little bit better. So yeah, we’ll keep a close eye on Carvana just, you know, everything going on with them with their debt restructure, and investor and sentiment is obviously a little bit stronger. We know in the past Carvana has had a couple of deals not be able to kind of market so the fact that they’re doing pretty well and keeping to their cadence says a little bit about how investors feel about some of the steps that they have taken. So we’ll keep a close eye on them and see how that pans out the rest of the year.

Joey Pizzolato 5:48

Great, thanks, man. That was his little surprise that the floorplan financing landscape is changing as dealers go out of business dealers acquire other dealers Riley’s September feature covered that market in depth. So Riley give us top line what’s going on in floorplan financing?

Riley Wolfbauer 6:05

Yeah, so as you said it has been changing. Over the last year we’ve seen several banks including Capital One and Fifth Third, pull out a floor plan financing to prioritize more profitable business lines. But then pulling out has opened up market opportunity for other lenders, first business bank and nextgear Capital which are both independent dealer floorplan financers. They both saw an increased opportunity with banks pulling back they’ve had more dealers reach out looking to open up lines of credit as other lenders are tightening up their standards. So that’s been a area of growth for them. They’ve had more people reach out, just looking to get new lines of credit to continue operating their dealerships. Another thing that’s impacting floor planning is dealer consolidation. We’ve seen dealer consolidation activity pickup starting in 2021 is continued to be strong throughout 2023 So far, Huntington for one they they underwrite many dealers that are actually consolidating right now. So their dealer base is growing, as their as the dealers that they work with are acquiring more dealers. And same goes for Chase auto as well. Then I also spoke with GM Financial, and they’ve made progress on increasing the number of GM dealers that they for planning for their goal has been to increase that and they’ve actually got it up to 45% of General Motors do General Motor Dealers across the United States.

Joey Pizzolato 7:54

Great, thanks, Riley. If you haven’t already, be sure to check out his feature floorplan shuffle lenders bolster portfolios amid market opportunity. It’s a great read. Finally, empower sports BRP reported its quarterly earnings Friday, Johnny has the details.

Johnnie Martinez 8:13

Yeah, so VRP earnings came out, they saw significant sales growth quarter over quarter 41%. And really, the big thing is what they’re seeing, you know, the influx of new entrants into the market is continuing for the powersports. Industry. What, but on their end, they’re seeing kind of this this higher end customer, for lack of a better term, right? Higher FICO scores higher income. And that’s kind of why they’re seeing maybe a little more stability than the rest of the industry is the higher end customer maybe isn’t feeling the the impact of the macroeconomic conditions the same way. It also goes into kind of what they’ve seen from their financing side, which is, you know, 60 to 65% financing versus 35 to 40% cash. We were hearing that even earlier in the summer for from other dealers, and it kind of started to shift BRP is sort of at that point now. So whatever trend they’re seeing, they’re kind of not getting hit as hard as maybe some of the other people that we’ve heard of, but they are still dealing with things like higher floor plan for their dealers, and they’re kind of keeping their promotions at an elevated level 27% as what they reported for the period.

Joey Pizzolato 9:22

Great. Thanks, Johnny. That about does it for today’s episode. As a reminder, you can purchase your all access pass to the auto finance summit in the powersports finance summit to attend both events October 29 to the 31st at the Bellagio in Las Vegas for 20% off and get your all access pass and WWW dot auto finance dot live. Thanks for joining us on the roadmap and be sure to follow us on AIX or formerly known as Twitter and LinkedIn. And we’ll see you online at auto finance news.net in here next time

https://www.autofinancenews.net/allposts/risk-management/podcast-weekly-wrap-on-carvana-abs-floorplan-shakeup/ Podcast: Floorplan, Carvana Subprime ABS