Consumers put the brakes on subscription-based features

Survey highlights:

-

69% of car shoppers say they would rather not subscribe to a feature than prepay.

-

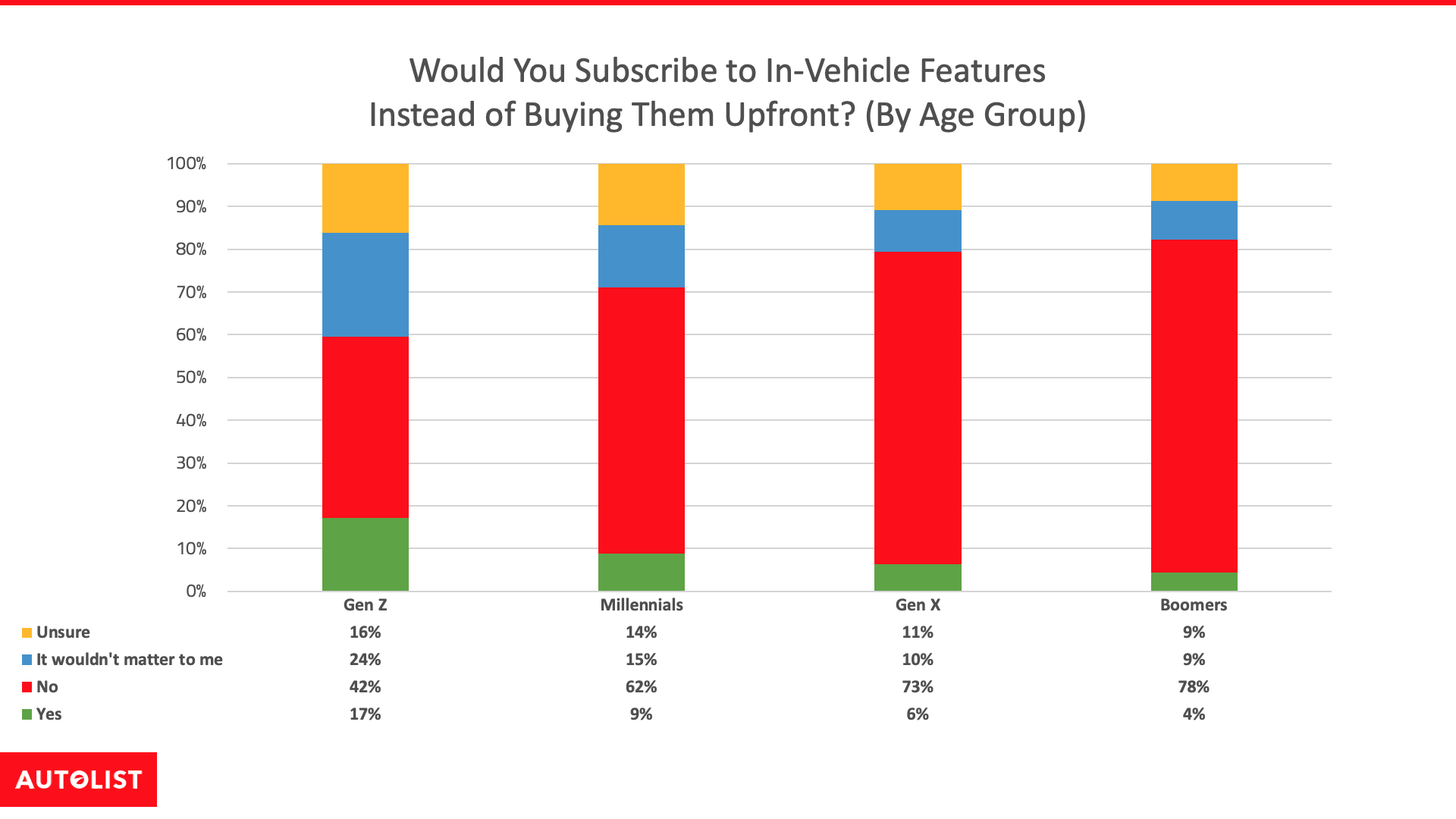

Younger shoppers (Gen Z) were the most open to the idea of subscriptions than millennials, Gen X, or baby boomers.Older respondents are more likely not to subscribe to features

-

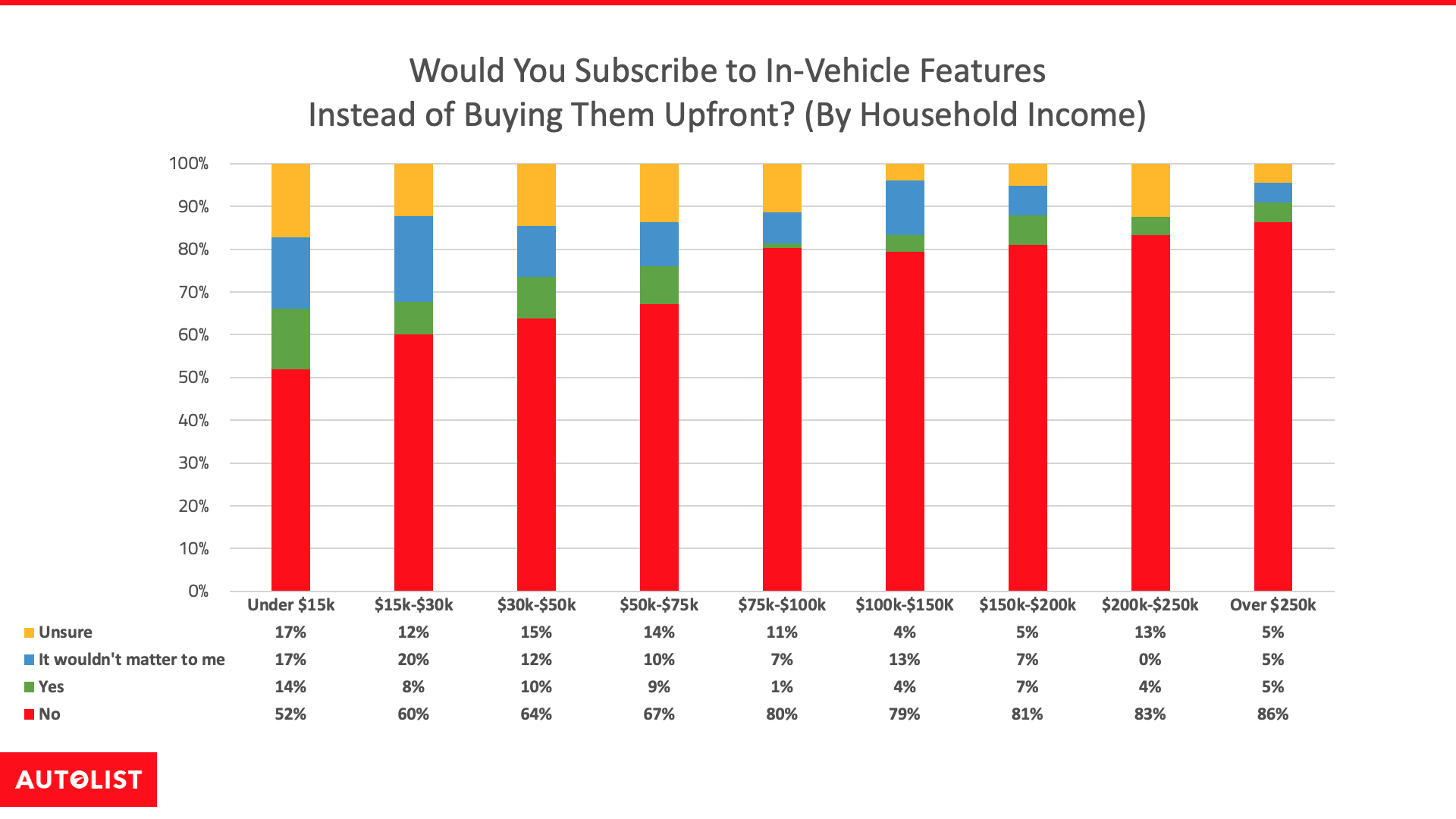

High-income households are less likely to opt for subscription-based features than low-income households

-

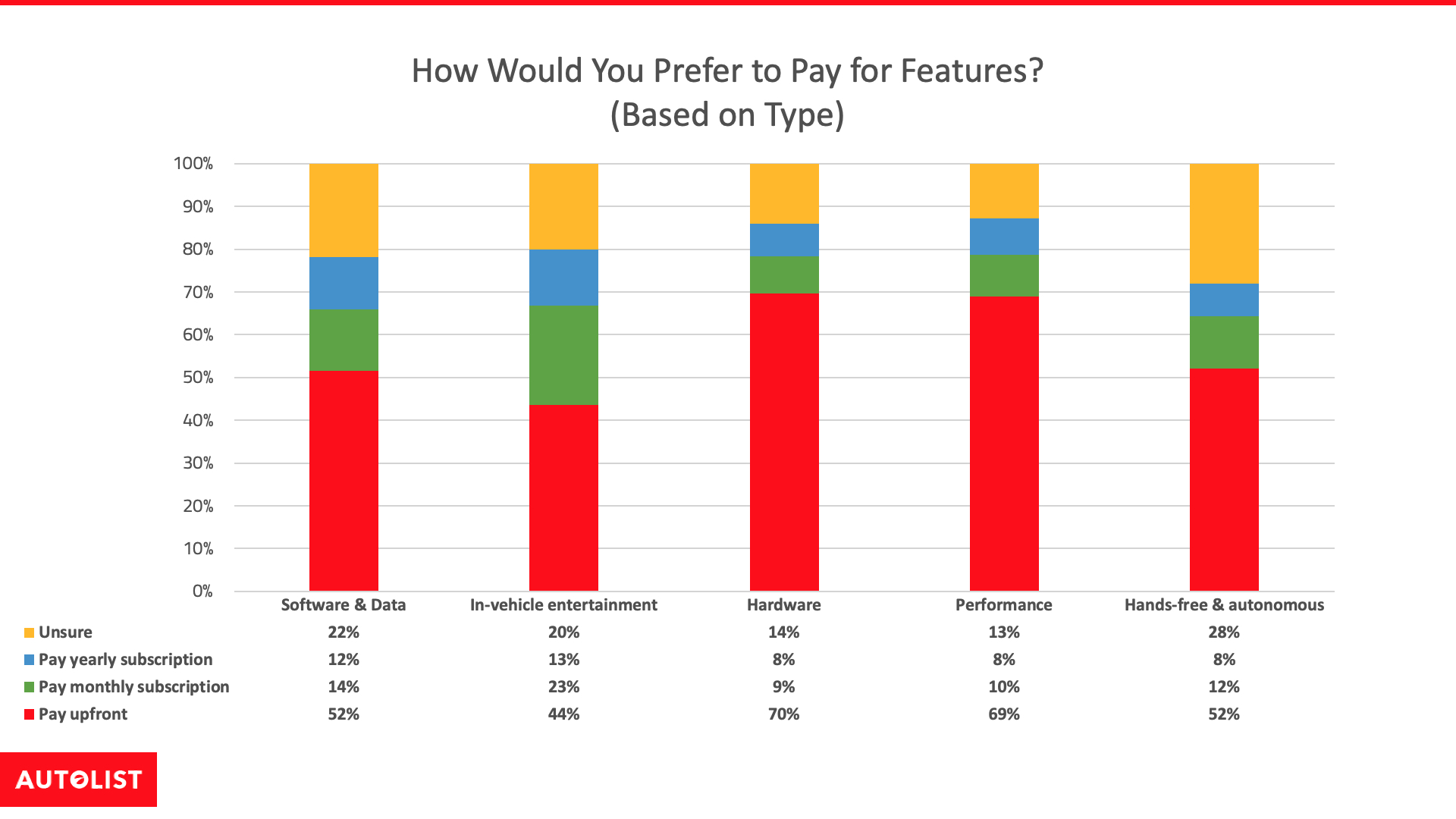

When split by the types of features people were most likely to consider subscribing to, in-car entertainment was the most popular, while hardware-related features such as heated seats were the type of features people were least willing to subscribe to. bottom.

Full story:

Automakers across the industry see billions of dollars in revenue in the near future from subscription-based features in their cars. But their plans still face a significant speed bump that’s worth noting. Consumers hate this idea.

That’s according to a recent study by Autolist.com, which found that 69% of car buyers generally don’t subscribe to vehicle features. Only 7% of consumers supported this idea.

High-income households who participated in the study (those more likely to purchase higher-end trim or luxury models that are more profitable) were also more likely to reject a subscription approach.

But Autolist’s research also found that companies like BMW, Volvo, Stellantis, and General Motors have already started promoting this payment method.

Gen Z shoppers in our survey tended to be more open to the idea of subscribing to features than millennials, Gen X, or baby boomers. Autolist found that the younger the respondents, the more likely they were to consider subscribing.

It also showed that consumers were more willing to subscribe to certain features (in-car entertainment) than others (heated seats).

“Brands expecting a significant revenue stream from a subscription model should be aware that getting consumers on board will take time and be compelling. You run the risk of alienating buyers, especially those with the greatest profit.”

Overall impression:

The Autolist study will survey 1,200 current car buyers in February 2023 to find out what their attitudes are towards subscribing and pre-paying for features and services when buying a car for the first time. I measured.

Overall, resistance to the idea was widespread.

69% of respondents said they would not subscribe to a feature or service rather than pay once. 7% were in favor of subscription models, 12% were neither for nor against, and 12% were unsure.

ok boomer:

Autolist’s research segmented these responses by age group (Gen Z, Millennials, Gen X, Baby Boomers) to see if consumer age had an impact on responses.

It turns out.

As previously mentioned, Gen Z shoppers were more open to the idea of subscriptions than all other age groups.

“This makes sense for us,” said Lydstone. “Young shoppers have grown up in an era where they subscribe to everything: music, games, entertainment, clothes and shoes, food. No. More than baby boomers.”

The openness of young shoppers here could also affect cars for which automakers offer subscription-based features. An inexpensive entry-level model makes more sense than a more expensive, premium model or trim.

“Because affordability of new cars is always a concern for young buyers, offering features on a monthly or annual basis could be an opportunity for automakers to keep the initial price of the car down.” Lydstone said. “The more income an owner has while owning a car, the more features they can pay for.”

Focusing subscription-based amenities on lower-priced vehicles can be important for another reason.

Household Income Matters:

Autolist’s research found that respondents with higher household incomes were more likely to be against subscribing to features, more so than paying up front.

For example, 57% of households with an annual income of less than $30,000 said they were unwilling to subscribe to the feature, while 10% said they would.

In contrast, 83% of households with incomes above $150,000 said they were unwilling to join, and 6% said they would.

Features and Service Types:

But Autolist’s research reveals that not all subscription-based features and amenities are created equal. When features were grouped into five different categories, there was some disconnect between what people wanted to subscribe to and what they wanted to pay upfront.

Those categories are:

-

Software and data features: Real-time traffic updates, over-the-air updates, vehicle maintenance reports, and more

-

in-car entertainment: streaming audio and video services, WiFi connectivity, games, and more

-

Hardware interlock function: Heated seats, heated steering wheel, adaptive headlights, etc.

-

Additional performance features: Extra Horsepower, Faster 0-60 Acceleration Capability, Adaptive Suspension Features and More

-

Semi-autonomous or fully autonomous hands-free driving capability

Respondents were asked if they would prefer or were unsure about prepayment, monthly subscriptions, or yearly subscriptions for each category.

hardware Features ranked as the category with the most respondents (70%) preferring prepayment over subscription.

performance Features come second, with 69% of shoppers saying they want to pay for these up front.

in-car entertainment, while it ranked in the category with the fewest respondents (44%) wanting to pay upfront. This category also had the highest percentage of people who said they would subscribe monthly, at 23%.

“Once again, we are seeing the impact of subscriptions in other industries,” says Lydstone. “Consumers are used to the idea of paying a monthly fee for streaming audio and video, so it makes sense for them to bring it into their car on a monthly basis.”

“At the same time, hardwired features such as seat heaters and anything related to vehicle performance still don’t match the actual vehicle because people don’t want to pay more for what they expect to have. They are considered closely related,” he added.

https://www.autolist.com/news-and-analysis/2023-survey-subscription-features Consumers put the brakes on subscription-based features